HR News & Education

Check out the latest news and resources for small businesses covering topics such as human resources, employee engagement, and management.

Employers Guide: How to Fill Out 2020 Form W-4

It's important that your employees complete Form W-4 correctly. If not done with care, employees could end up having too little withheld and owing a significant amount of money to the IRS in April.

The revamped 2020 Form W-4 raises many questions for employees completing this version for the first time. In this guide, we will break down the new form and how you can help your team.

What is Form W-4?

Employees complete a W-4 upon hire to let you know how much money to withhold from their paycheck for income taxes.

As the employer, you are responsible for withholding the correct amount and sending it to the Internal Revenue Service (IRS). If an employee does not complete a W-4, the IRS requires that you withhold at the highest rate. Most payroll providers will handle the withholding and transfer of funds for you.

What is new about the 2020 Form W-4?

No more allowances. The Tax Credits and Jobs Act (TCJA), passed in 2017, eliminated personal exemptions, deeming allowances no longer necessary.

Previously, the more allowances an employee claimed meant less money withheld for taxes. Since that is no longer how it works, the new form ditches the personal allowances worksheet altogether.

The new name also reflects the recent changes— "Employees Withholding Certificate," formerly known as the "Employees Withholding Allowance Certificate".

How to Fill Out 2020 Form W-4

The 2020 W-4 has thrown employees for a loop. Follow these five steps to help your team navigate the new form.

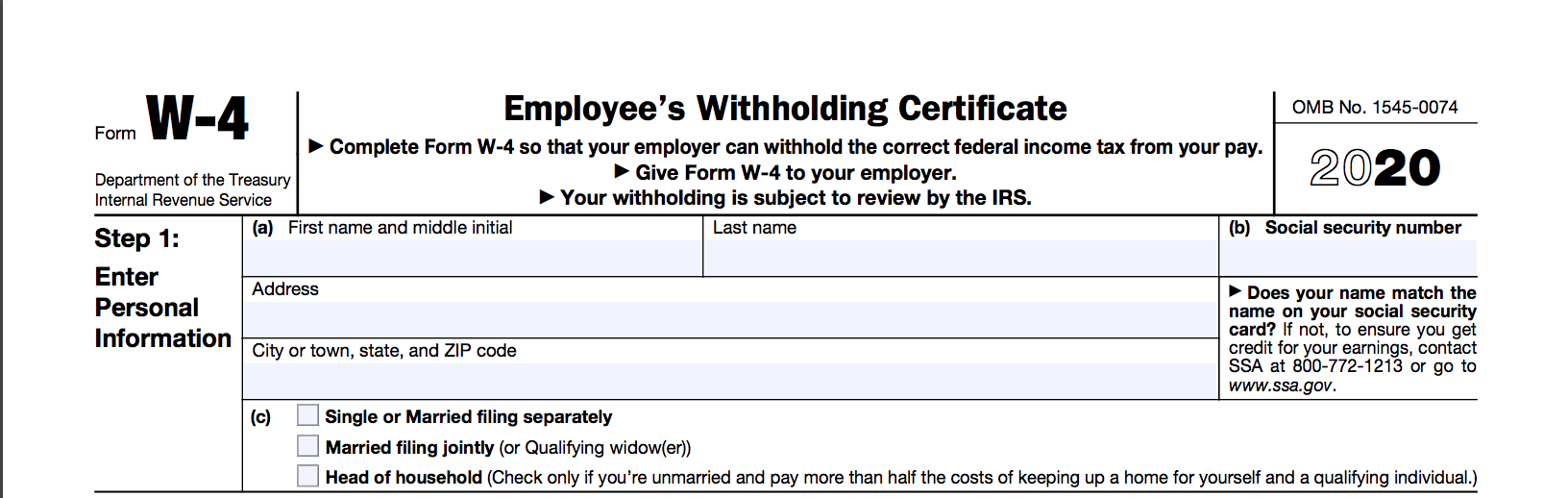

Step. 1: Enter Personal Information

This step applies to everyone. Name, Address, and Social Security Number are needed to transfer withholdings to the IRS.

Filing status is now the primary indicator of how much money is to be withheld. If an employee does not complete a W-4, you must calculate their withholdings at the "Single" rate.

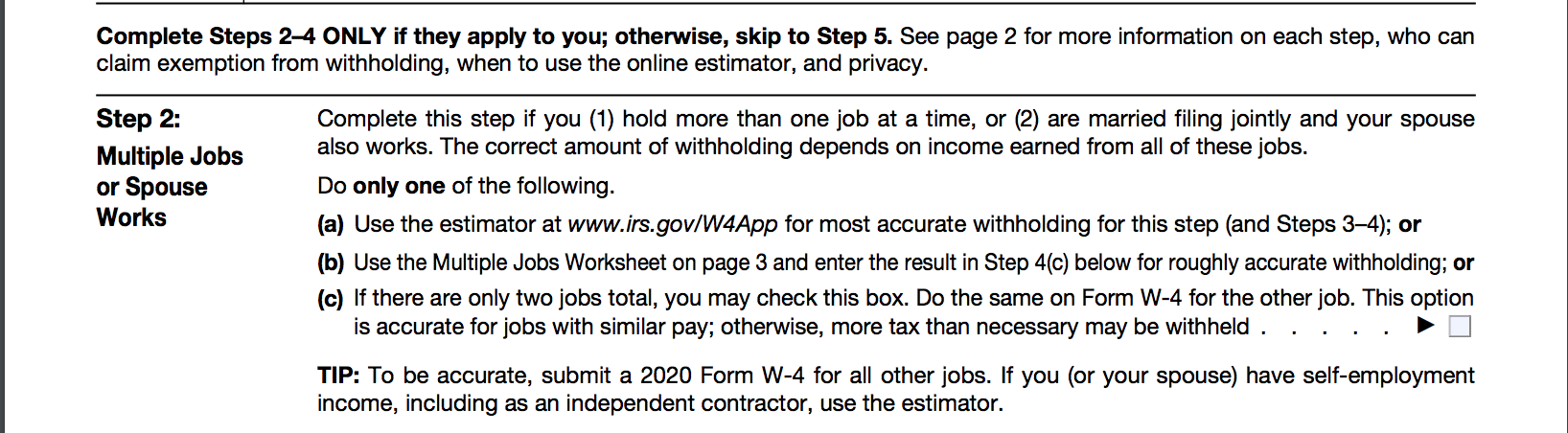

Step. 2: Multiple Jobs or Spouse Works

This step does not apply to everyone. Employees only need to complete this step if:

- They have more than one job at the same time

- They are claiming Married filing jointly, and their spouse also holds a job

If either of the above applies, they have three options to complete the section, (a), (b), or (c).

The IRS advises:

- 3(a), the online estimator will provide the most accuracy and privacy.

- 3(b), the MultipleJobs Worksheet provides less accuracy and involves manual work (leaving more room for error).

- 3(c), the checkbox is the easiest but provides the least accuracy. Employees should only use this option if there are only two jobs of similar pay.

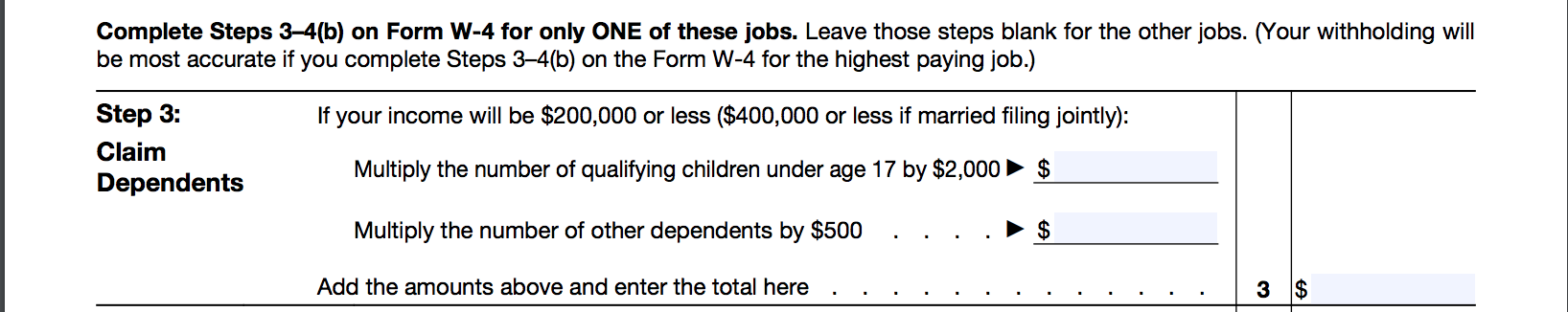

Step. 3: Claim Dependents

Employees with dependents should complete this step to determine eligibility for the Child Tax Credit. The TCJA expanded eligibility requirements to extend the credit to more Americans. Now, Single filers with an income of $200,000 or less ($400,000 for joint filers) qualify for the tax credit.

Employees will calculate by multiplying the number of qualifying children under 17 by $2,000 and the number of other dependents by $500. Add the dollar sum amount of the two totals to line three.

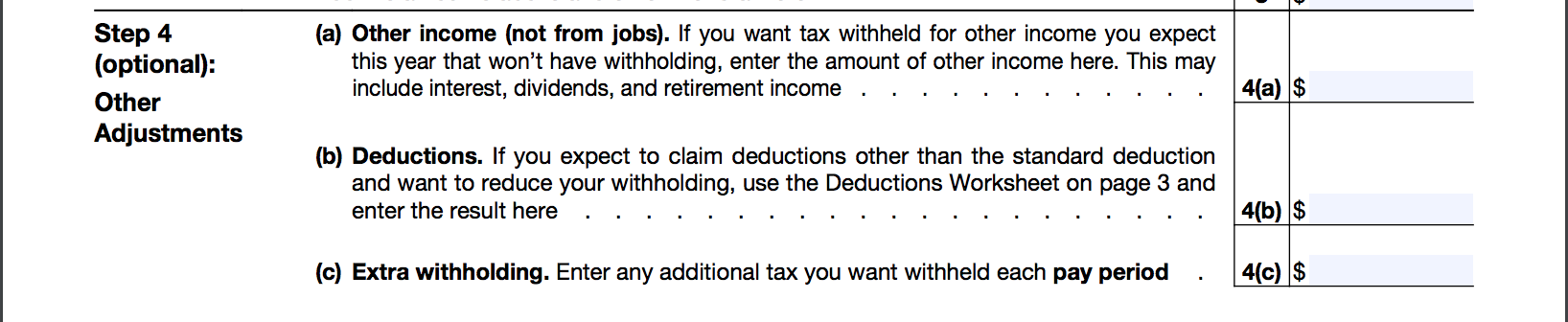

Step. 4: Other Adjustments

This section is optional for everyone. Employees should only complete this section if they want additional money withheld from their paycheck. To opt-in, employees can complete one or more of the three sections:

- 4(a) Other income (not from jobs). Employees can enter the amount of income they expect to receive for dividends and interest potentially subject to tax.

- 4(b)Deductions. Employees should complete this section if they plan to claim deductions other than the standard deduction. The Deductions Worksheet on page three of Form W-4 will help estimate deductions.

- 4(c)Extra Withholding. Employees can enter an additional amount to withhold from their paycheck every pay period.

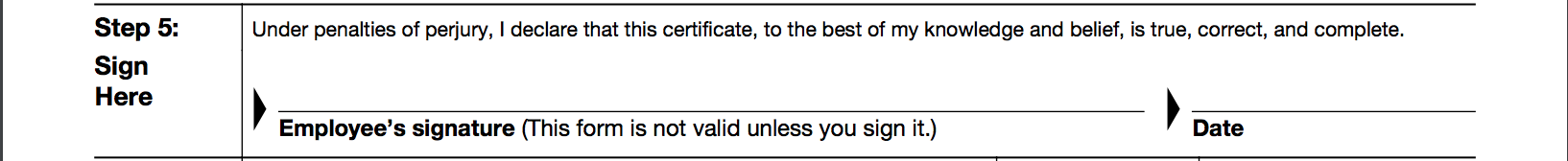

Step. 5: Sign & Date

The easiest yet most critical step. If your employee does not sign and date the form, it is not valid.

When should employees fill out a new W-4

For the most part, employees should fill out a new W-4 anytime they experience a significant life change like getting married or divorced, adding kids or other dependents to the family, etc.

Employees can also change their withholdings at any time by submitting a new Form W-4.

Tips

Work with a Payroll Provider

Working with a payroll provider can save you time and keep your business compliant. Most payroll providers will take care of employee withholdings for you.

With Symply, your employees can digitally complete Form W-4 and update their withholdings on their own at any time. This saves you time, eliminates paper processes, and ensures your employees’ information is integrated and accessible all in one place. Learn more here.

Encourage Employees to Review

Encourage your employees to review and evaluate their W-4 each year. People get busy and forget to submit a new form after a life event or legislative changes. Employees who find they do need to submit a new W-4 should do so as soon as possible in the new year.