HR News & Education

Check out the latest news and resources for small businesses covering topics such as human resources, employee engagement, and management.

Updated COVID EIDL Program: What Small Businesses Need to Know

There’s $150 billion left in the COVID EIDL program for small businesses.

Even if you already received a loan, you may be eligible for an increase due to back and forth restrictions and the Delta Variant impacting your business and revenue. If you’re just now starting to feel the weight of the pandemic, it’s not too late to apply.

The application portal is open until December 31, 2021, or until funds are exhausted. The SBA recently announced new changes to the program— here’s what we know.

EIDL vs. COVID EIDL

EIDL (Economic Injury Disaster Loan) is a loan program provided by the SBA to help businesses recover from an economic disaster or “economic injury.” Most businesses with less than 500 employees can apply for a loan if they are in a disaster area and experience a financial loss that prevents them from paying necessary operating expenses. Typically, the EIDL program will step up in situations like hurricanes, fires, tornados, floods, and storms.

In the spring of 2020, the SBA declared the entire nation a disaster area due to COVID-19 and developed a special COVID EIDL program to help as many U.S. businesses stay alive financially as possible.

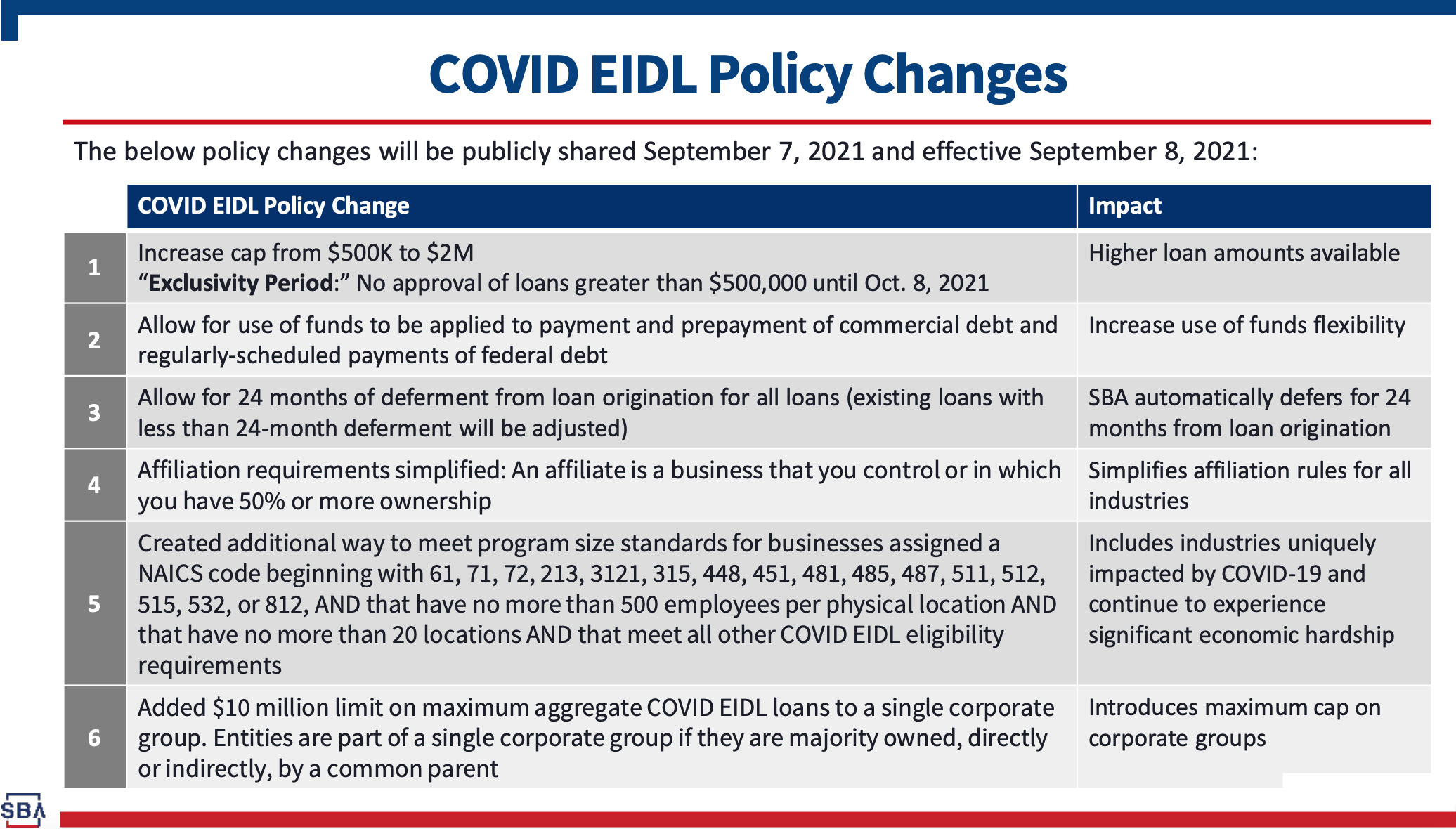

Recent changes to COVID EIDL

As the pandemic continues to impact small businesses nationwide, the SBA announced some new changes to the COVID EIDL on September 8, 2021, including:

- Increased COVID EIDL cap. The maximum loan cap increased from $500,000 to $2 million.

- Extended deferment payment period. Repayment of these loans is deferred until two years after loan origination. Existing loans with a less than 24-month deferment will be adjusted)

- 30-Day Exclusivity Window. From September 8 - October 8, 2021, small businesses will have an exclusivity window to apply for loans of $500,000 or less.

- New Eligible Use of Funds. Borrowers can now use COVID EIDL loan funds toward commercial and federal business debt.

- Expanded eligibility for specific NAICS codes. Additional ways these businesses can meet the program's size standards.

- Simplified affiliation requirements. An affiliate is now defined as a business that you control or have 50% or more ownership of— similar to the Restaurant Revitalization Fund model.

- Max cap on corporate groups. Aggregate COVID EIDL loans to a single corporate group are capped at $10 million.

Eligibility

Your business is eligible for a COVID EIDL if it meets all of the following criteria:

- Experienced a financial loss due to COVID

- Physically located in the U.S.

- Employ no more than 500 people across all affiliates (some exceptions apply to certain businesses)

- Have no more than 20 locations

- Operating by January 31, 2020

Your business must also have a valid IRS-issued tax identification number. Each owner, member, partner, or shareholder owning 20% or more of the business must also be a U.S. citizen, non-citizen national, or qualified alien with a Social Security Number. For more information on immigration status, visit SOP 50 30 9, Appendix 7.

If you are a sole proprietor, you must be a U.S. citizen, non-citizen national, or qualified alien with a valid Social Security Number to be eligible for COVID EIDL.

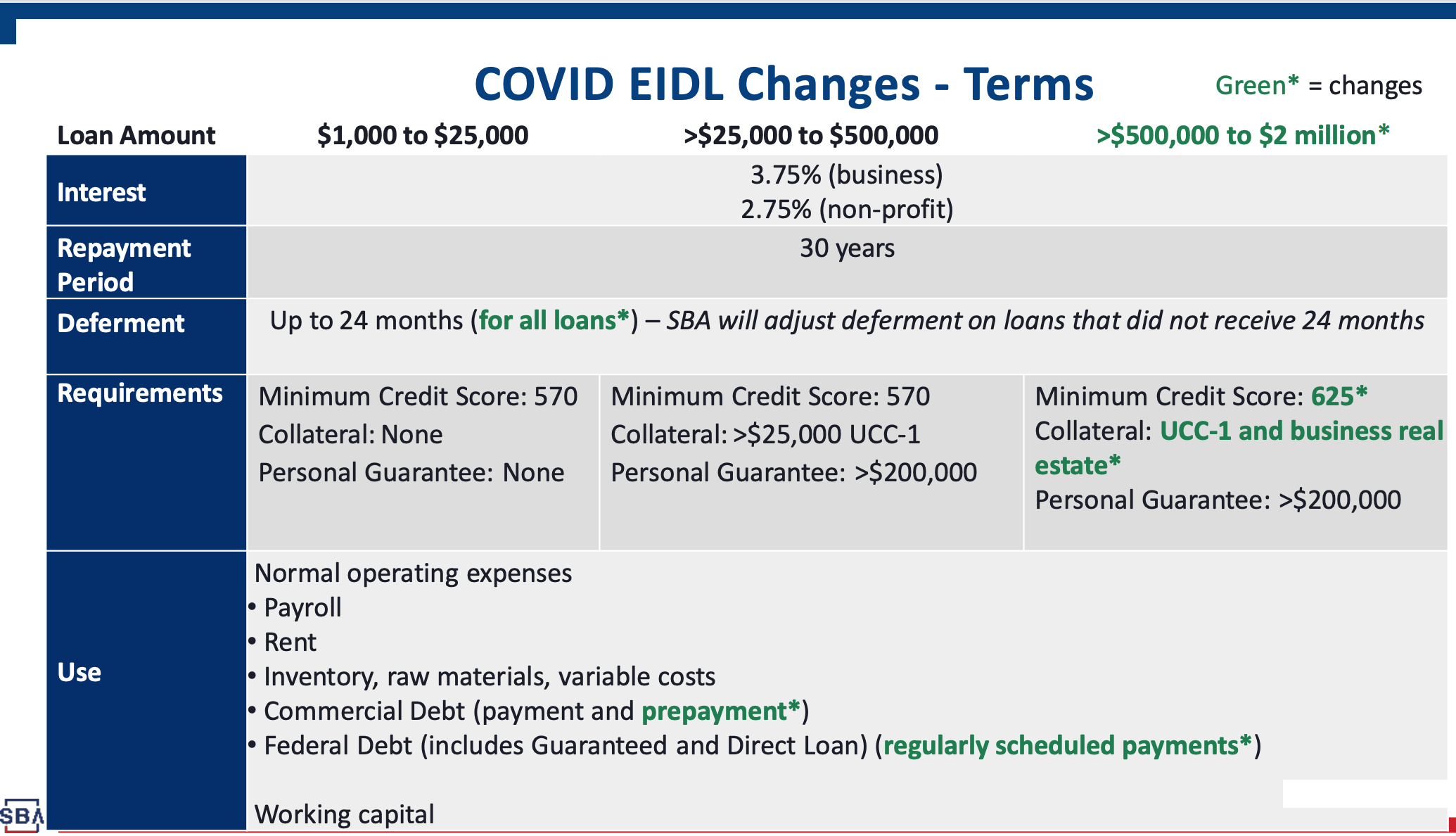

COVID EIDL Terms

The September 8 announcement included a few changes to the COVID EIDL terms, the most important being the expanded use of funds. Here is a breakdown of the complete loan terms:

- Loans cap at $2 million

- 30 year repayment period with an interest of 3.75% for businesses and 2.75% for non-profits

- Two year deferment period for all loans (SBA will adjust loans that did not receive 24 months)

- Applications for COVID EIDL are open until December 31, 2021, or until funds run out.

- Collateral required for loans over $25,000 and a personal guarantee required for loans more than $200,000

- A minimum credit score of 570 required for loans under $500,000 and a minimum credit score of 625 for loans over $500,000

- Acceptable use of COVID EIDL funds include:

- Payroll

- Rent

- Mortgage

- Utilities

- Inventory, raw materials, variable costs

- Commercial debt payment and prepayment

- Regularly scheduled payments on federal debt, including Guaranteed and Direct Loans

- Other ordinary business expenses

- Payroll

- You cannot use funds to expand your business, start a new business, or make prepayments on debt owned by a federal agency or an SBIC

- Fees required for loans over $25,000

- Loans greater than $25,000: $100 one-time fee for filing a lien on the borrower’s business assets

- Loans greater than $500,000: $100 one-time fee for filing a lien on the borrower’s business assets, and the borrower is responsible for recording the real estate lien and paying the associated fees if using real estate as collateral.

- Loans greater than $25,000: $100 one-time fee for filing a lien on the borrower’s business assets

How to apply

New COVID EIDL application

Visit https://covid19relief.sba.gov/#/ to complete your application online. The application portal walks you through the process step-by-step, and the SBA will reach out to you directly if any additional information is needed.

Be prepared to submit the following documents with your application:

- Federal income taxes

- IRS Form 4506-T

- Additional documents required for loans over $500K:

- ODA Form P-022 — Standard Resolution

- SBA Form 2202 — Schedule of Liabilities

- List of real estate owned

- SBA Form 413 — Personal Financial Statements

You can check the status of your application through the portal at any time, but keep in mind the following turnaround times:

- Application for loans under $500,000: 3 weeks

- Application for loans over $500,000: 6 weeks

- Application for loans under $500,000 with an increase for over $500,000: 9 weeks

COVID EIDL increase application

If you already received a COVID EIDL, you can apply for an increase up to the amount you qualify for or the $2 million cap, whichever is lower. Applications to increase a loan will most likely have to wait until the exclusivity period ends on October 8, when applications for funds over $500,000 are accepted.

Log into your account through the COVID EIDL portal to submit a request for an increase on your loan. Make sure you do not apply for another loan, or your application might be flagged as fraudulent.

Loan increase amounts are determined by how much your business qualifies for if you applied today minus any funds, you have already received from COVID EIDL. Most likely, you will not need to resubmit any standard documents with your request for an increase. You can check the status of your application at any time by logging into your portal.

If you have any questions or concerns about your application, you can contact the SBA Customer Service Center at 800-659-2955 or email DisasterCustomerService@sba.gov.